Create a Money-Saving Chart You'll Love this 2025

Create a Money-Saving Chart You'll Love this 2025

Are you looking for a way to save money in the new year? If so, creating a budget is an essential first step. A budget will help you keep track of your expenses and income, and make sure that your financial goals are reachable. But why stop there? To ensure that you are saving as much money as possible, consider creating a money-saving chart this 2023.

What is a Money-Saving Chart?

A money-saving chart is a detailed spreadsheet or document that lists all of your monthly expenses and sources of income. It includes categories such as housing, utilities, food, entertainment, clothing, medical bills, investment plan, and any other expense you incur each month.

Additionally, it can help clarify the difference between savings and investments. While savings typically refer to money set aside for short-term needs or emergencies, investments involve allocating funds to assets with the expectation of generating a return over time. This distinction is important as it allows you to strategize effectively for both immediate and long-term financial goals.

Why Do We Need a Money-Saving Chart?

A money-saving chart is an essential tool to help you stay on top of your finances. It will give you a clear overview of where your money is going each month, and it can also help you stay organized by categorizing your expenses in one place. If you find that there are areas where you can be more mindful about saving money, such as figuring out the steps to building an emergency fund, this chart can help you identify those areas and come up with strategies to save money in the long run.

What are the Benefits of a Money-Saving Chart?

A money-saving chart provides several important benefits that can improve your financial management. It gives you a clear view of your income and expenses, helping you see where your money goes. By tracking your spending, you can find areas to save more effectively. The chart also helps you set realistic savings goals for things like emergencies, vacations, or payments of your insurance plan in the Philippines.

Additionally, it enhances your budgeting skills and encourages you to be more mindful of your spending habits. Regularly checking your progress reinforces the habit of saving and can reduce anxiety about managing money. Seeing your savings grow serves as motivation to keep working towards your financial goals. The flexibility of the chart allows you to adjust your budget and goals as your financial situation changes.

How Do I Make My Own Money-Saving Chart?

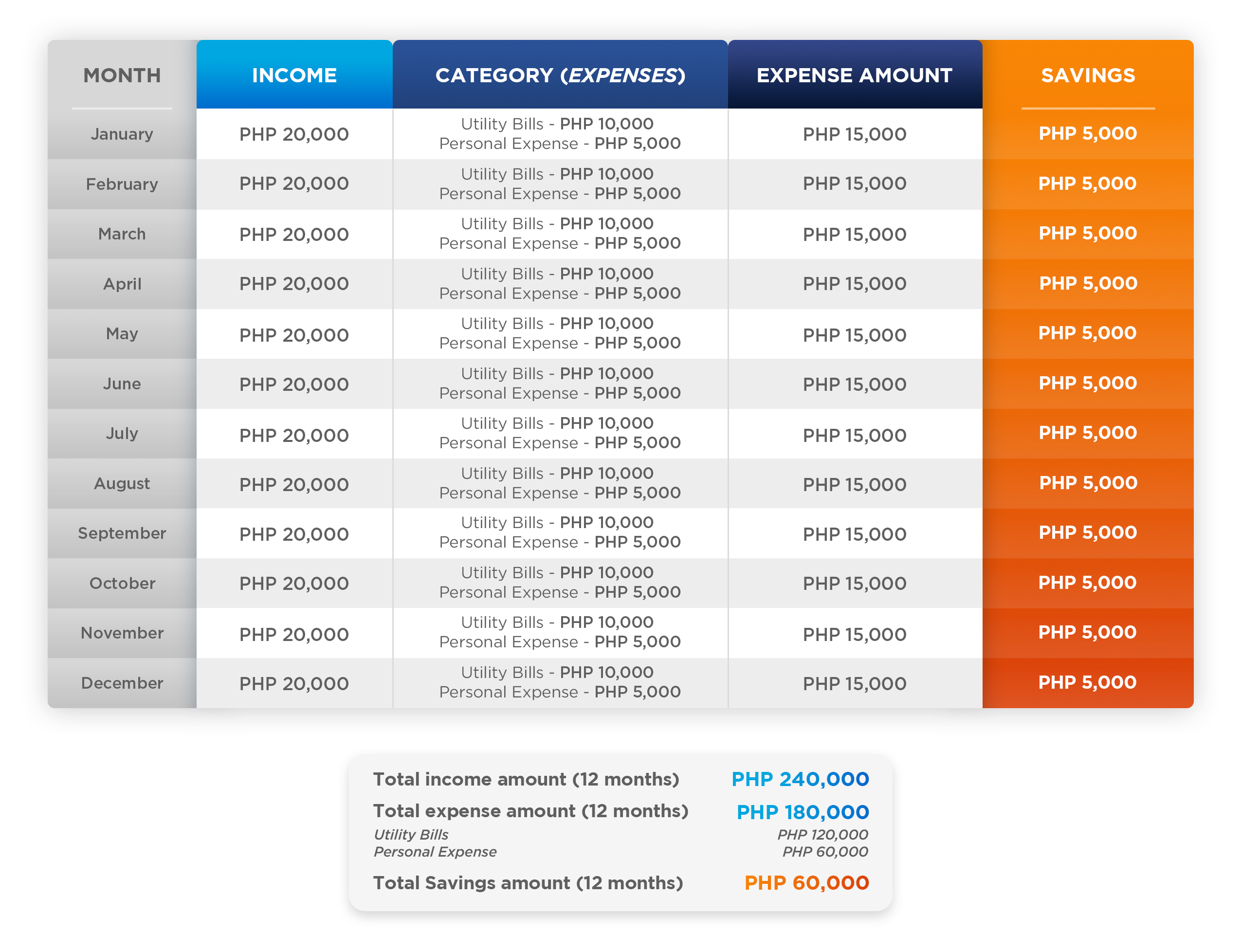

Creating your own money-saving chart is simple! First off, start by determining what type of document or spreadsheet works best for you - whether it be Microsoft Excel or Google Sheets. Once you have chosen the right platform for your needs, create columns labeled “Category” and “Amount”. Then fill in each category with its corresponding amount spent over the course of the month (make sure to include both fixed expenses such as rent or mortgage payments and variable expenses such as groceries).

After that’s done add up all of your spendings and subtract it from your total income - if there's anything left over then congratulations - that's your savings!

Now comes the fun part - setting savings goals! Take a look at where most of your money is going each month - if it’s going towards unnecessary items like clothes or eating out then try setting aside a certain percentage of those funds into an emergency fund or an insurance policy like InLife’s Wealth Assure Plus instead! You can also challenge yourself by cutting back on certain expenses each month until you eventually reach your desired savings goal.

Money management can be difficult but having a visual representation can make it easier than ever before to stay on track with your finances this 2023. Creating a money-saving chart helps identify areas where extra funds can be saved while also allowing users to set realistic financial goals throughout the year. So why not give it a try? Here's something to start with.

The Value of Money-Saving Charts in Financial Management

Money-saving charts are essential tools for improving your financial management. They provide a clear overview of your income and expenses, helping you identify areas for effective savings and make informed financial decisions. Additionally, these charts clarify the importance of having a savings account, which not only offers a safe place for your money but also promotes the habit of saving for emergencies and future needs.

By combining a money-saving chart with a solid savings strategy, you can enhance your financial security and work towards your long-term goals. Start using a money-saving chart today to so you can work on achieving your financial dreams one step at a time!