How Can We Help?

Choose a category to quickly find what you are looking forA provision which allows the policy owner to choose whichever way he wants to utilize his earned dividends. There are five ways:

- Cash Payment Option – the simplest option wherein the insurance company will send the policy owner a check each year (provided that the insurance company has a good experience each year).

- Premium Reduction Option – the dividends earned are applied towards the premium due, thus, reducing the total amount of premium to be paid by the insured for a specific period.

- Interest Option – the dividends are left to the company to accumulate. Accumulated dividends are available for withdrawal at any time.

- Paid-Up Additions Option – the earned dividends are automatically used to purchase additional coverage

- Buy Yearly Renewable Term – the earned dividends are automatically used to purchase a yearly - renewable term insurance – meaning the extra coverage bought by the dividends is good for one year only.

Ask yourself these questions:

- If something happens to me, can my family continue to live normally and afford all the daily expenses I've left behind?

- If something happens to me, can my family settle all my debts (housing loan, car loan etc.)?

- If something happens to me, can my kids still go to college?

- If something happens to me, can my family survive financial hurdles?

You get life insurance to ensure that your loved ones can continue living even if you're no longer around.

To get a life insurance is to protect, care and safeguard your future.

- Dying too soon – Insurance provides money that can take care of expenses associated with the early demise of a breadwinner.

- Living too long – Insurance ensures that in old age, people will not be dependent on their families for their daily needs.

- Being disabled – Insurance will ease the financial pains and difficulties of being disabled.

Life insurance may not be able to prevent these threats/contingencies from happening but it can help in cushioning the financial impact any of them could bring.

Ideally, people who have families or dependents should have life insurance, especially if you are the main or sole person providing income to spend on your family’s living expenses. These include:

- Parents with minor children – If one or both parents die before a child reaches maturity, life insurance can provide a child with financial resources for their education and living expenses until they can support themselves.

- Parents with special-needs children – Some children with special needs may need lifelong assistance even into adulthood. Life insurance can ensure their child has the financial resource to access special care when their parents are no longer around.

- Adults with joint property – If you and another adult (e.g. spouse, fiancé, sibling, business partner) own properties like residential and commercial buildings, companies, vehicles, and other expensive properties, your death may make it difficult for them to continue paying for upkeep, loans, and taxes. Life insurance can allow them to get by.

- Families that cannot afford funeral expenses – The cost of a private funeral in the Philippines can fetch hundreds of thousands of pesos minimum. If you feel like your family can be financially secure enough but may not be ready for the unexpected costs of a funeral, your life insurance can be used to pay for your funeral.

- Young adults with no dependents – Even if you don’t have dependents yet, it may be smart to invest in life insurance now while you’re young and healthy.

The concept is simple: pay life insurance premiums for a given amount of time, and upon your death, your beneficiaries are covered and entitled to a death benefit. However, this is where it gets a bit complicated since life insurance is different between all policy holders.

Your premium is the money you’ll be paying for your death to remain covered by the insurance company. How high or low your premium is depends on the likelihood your insurer will have to pay your death benefit, or in short: your life expectancy. A healthy 25-year-old with no pre-existing condition, therefore, will have a much smaller premium than a 40-year-old with pre-existing conditions that could give them a shorter life expectancy. Other factors that can affect your premium include:

- Age – Younger Filipinos are less susceptible to diseases and conditions that shorten their life expectancy.

- Gender – Women and men are more prone to certain conditions that could affect their life expectancies.

- Medical History – Those that have been treated for or have a pre-existing health condition may pay a higher premium.

- Occupational Hazards – Some jobs (e.g. driver, engineer in a construction site, electrician) have bigger chances of fatal workplace accidents than other jobs (e.g. white-collared desk jobs).

- High-Risk Hobbies – Heavy smokers and drinkers have a shorter life expectancy compared to those who don’t.

- Larger Death Benefits – Policy holders that want a bigger death benefit for their beneficiaries can expect larger premiums.

Life insurance has a simple purpose; to help prepare and protect your family financially if you are no longer around. A life insurance payout or death benefit can be used in any way your family sees fit. It can be used as:

- Clean-up Fund – a fund to pay all debts upon death. This can include outstanding hospital/medical bills, burial expenses etc.

- Family Dependency Period Income – a fund to provide income for your family and cover their living costs.

- Emergency Fund – a fund to be used in the event of illness, accident or unforeseen situation that may arise in your family.

- Education Fund – a fund to provide education for your children.premiums.

The younger and healthier you are, the easier it may be to secure the life insurance policy that you want. If you have a partner, spouse or family who may struggle to cope financially, then acquiring one today can give you the feeling of security.

If you have a family to support, the insurance provided by your employer or the company you work for may not be enough. What happens to that coverage if you change jobs? If you leave the company, you may have to forfeit the coverage you have. Having a personal policy can ensure your family has adequate protection from the unexpected.

It is important to determine the value of your life insurance in terms of what it will take for your family members to be financially independent in your absence. To estimate that amount, add up all expenses and calculate future liabilities that your family will have to pay in your absence. Your family's needs and goals must reflect in your insurance plan.

Check out Insular Life's financial calculators to help you determine your insurance needs and financial goals!

Life insurance is a good investment for the modern everyday Filipino who have people they want to protect financially even after they pass away. Depending on the type of life insurance you invest on, if you’re investing on the right type of insurance for your needs, you and your family can benefit from the safety blanket life insurance investments provide.

Unlike other investments, life insurance doesn’t fluctuate in value unlike other forms of investments. Your beneficiaries’ death benefit depends on how much premium you pay and not like investments that depend on the current state of the market.

As the first and largest Filipino life insurance company in the Philippines, we know a thing or two about providing beneficial life insurance to everyday Filipinos. We have over a hundred years of experience in financial protection, providing you with everything you need to give your loved ones a good future and your own peace of mind for the future.

We're here to help you plan ahead, every step of the way. Talk to an InLife Financial Advisor today.

Even the healthiest Filipino is at risk of a medical emergency. While some can afford to pay their entire hospital bill for private healthcare, many everyday Filipinos may face some difficulties paying for these large unexpected costs. This can lead to financial hardship for yourself and your family.

One way to protect yourself and your family from the financial burden of medical-related expenses is with a comprehensive health insurance plan. In this article, we explain how InLife’s health insurance plans can meet your different insurance needs and preferences.

Health insurance covers your medical expenses. Depending on how comprehensive your health insurance policy is, it can be as basic as paying for emergency room services and consultations, and can be as comprehensive as providing insurance for all your medical-related costs, including dental, psychiatric, and medicine costs.

Health insurance reimburses you for the medically-related expenses incurred. In some cases, it is also possible for the insurance company to pay the healthcare provider directly. Because of this, insurance companies that provide health insurance often have their own network of affiliated healthcare providers where their insurance applies. If a patient seeks healthcare outside of the company’s network or for a treatment that’s outside of their policy, the insurance provider may not cover it. This is why it’s important to get the best coverage for your needs and know your health insurance provider’s network.

While Filipinos are entitled to healthcare assistance from public hospitals or government organizations like PhilHealth, for many Filipinos it is preferable or even necessary to turn to private hospitals for certain emergencies or conditions. Some medical services like consultations and basic check-ups may be affordable for most, but when you consider the accumulated costs for you and your family, it can be a significant expense to carry.

It’s even more necessary if you consider the costs of an emergency medical situation. A trip to the emergency room or a highly-skilled operation can reach hundreds of thousands of pesos. While your family may be financially stable today, it only takes one accident or one unfortunate event that could lead you to financial difficulties because of a medical bill. And with medical inflation in the Philippines rising to 13.7% in 2019, the cost of medical expenses is expected to increase in the years to come.

When you or your family members are covered by health insurance, most (or all, depending on your coverage) of your medical expenses will either be reimbursed or the insurance will pay all the expenses covered by your policy. This can give your family plenty of benefits.

- Coverage for Expensive Medical Expenses – According to the Philippine Statistics Authority, most of the P526.3 billion Filipinos spend on healthcare annually was paid for out of pocket. This is either because they weren’t covered by health insurance or their health insurance policy was not comprehensive enough to cover the medical expense they incurred. A good health insurance policy for yourself and your family can help you avoid the burden of paying for medical bills out of pocket.

- Lost Income Replacement – Should you or another income-earner in the family get hospitalized or unable to go to work due to a medical procedure, our health insurance coverage includes a Lost Income Replacement feature. This provides your family with a daily cash allowance to cope with their daily living expenses while their income is compromised.

- Complements Life Insurance for Financial Security – Together with life insurance, health insurance can keep your family financially secure through these troubling times. Health insurance can pay for all your medical expenses. And should the worst happen to you, your life insurance can keep your family financially secure even after their tragic loss.

- Peace of Mind – Everyday Filipinos can appreciate the luxury of knowing that their family is safe and financially secure. In case of a medical emergency or unexpected condition that will incur huge medical expenses, you can feel safe knowing that you have a financial resource prepared for this type of emergency.

For over 100 years, InLife is the trusted provider of health insurance in the Philippines. We provide comprehensive health insurance plans to millions of Filipinos, giving them the financial resource to stay afloat despite the rising costs of healthcare in the country.

Our health insurance policies can include lifetime coverage that can ensure your health-related expenses are taken care of. At the same time, your family can be well provided for with a daily allowance to replace your household’s lost income. And with a comprehensive insurance plan, you and your loved ones can get some peace of mind knowing that your finances are safe from having to pay out of pocket for expensive unexpected medical costs.

Also known as “variable universal life insurance,” investment insurance provides both financial security and financial growth. True to its name, the definition of investment insurance has two main parts: an insurance plan and an investment.

In traditional insurance policy models, you or your beneficiaries only receive the benefit of an insurance policy after an unfortunate event. However, an insurance investment plan means that you also receive returns from your policy even before an unfortunate incident occurs.

In short, your premiums get you both the safety blanket insurance provides plus the profitable returns of an investment.

Traditional insurance is technically an investment in the sense that you’re putting away money to help you or your family when an unexpected incident could set you back financially. Technically, it’s an investment on your family’s financial security.

But if you’re looking at it as an investment where you’re expecting an ROI, traditional insurance models do not necessarily provide this. Think of typical insurance models as putting money in a piggy bank in your house. It’s safe and you’re not losing any money, but at the same time, you’re not gaining anything.

Your payouts are meant to help you and your family through a financially difficult event, but you cannot receive it until after that event has occurred. When your coverage ends and that event did not occur, you receive your premiums back.

Insurance investment plans are like a two-for-one investment. When you pay your insurance premiums, part of your premiums become investments after a certain period. As the value of your premiums grow, so does your investment.

This will result in a return on invesment (ROI) which you can access even before you receive your insurance pay out due to unfortunate circumstances. Your actual insurance, on the other hand, will remain untouched and whatever is agreed upon on your policy coverage will uphold. So, if by a good chance of fate you’ll never need to receive a payout from your insurance policy, you get both your insurance premium returned as well as the money you’ve received from your investment.

The only caveat here, however, is that because your premiums go to both your insurance and to your investment, you cannot withdraw from your account more than your policy’s minimum value. Other than that, you’re free to take out your ROI and spend or invest it wherever you see fit.

Investment insurance plans come with many benefits for you and your family.

- Benefits from Flexible Premiums – The more you pay, the more you earn. Our variable universal life insurance gives you the option to pay more than the average premium. When you pay more than the minimum, the excess is added to your investment, which helps your fund grow faster.

- Funds for Emergencies and Leisure– Having an investment on top of your insurance allows you to earn back some of your investment which you can spend or invest on anything you want. We recommend re-investing your ROI to stay on track, but having that extra income can help pay for family emergencies not covered in your insurance policies or simply for leisure purposes.

- Higher Returns – Unlike traditional insurance policies, investment insurance maximizes your earning potential by linking some of your investment to stocks and bonds. These can result in bigger funds compared to what you hoped to gain with your premium.

- You Don’t Compromise Your Policy – Many types of investments depend on the state of the market and can result in a loss. Your ROI may depend on the value of your premiums. However, this will not affect your insurance policy and will not be compromised by the results of your investment.

You may check out our various Investment Insurance plans here or talk to an InLife Financial Advisor to learn all the plans that suit your needs.

InLife is the first and largest Filipino life insurance company and the only mutual company in the Philippines. With over a century of experience in financial protection, insurance, investments, we’ve helped millions of Filipinos make smart financial decisions for their future. We recognize that everyone has different financial priorities, and we’ve given them the tools and resources to plan ahead, every step of the way.

We’re a Filipino company committed to serving everyday Filipinos who want to protect themselves and their families by building financial security.

The InLife app can be downloaded in 3 ways:

- iOS - App Store

- Android - Google Play Store

- PWA link - https://inlifeph.com/InLifeApp.

Click on this link https://inlifeph.com/InLifeApp

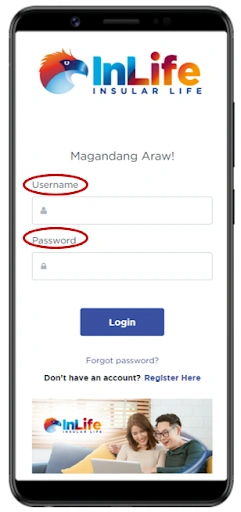

As an InLife Policyholder, you can log in using your Customer Portal credentials. Your username is either a name you elected or your email address and your password.

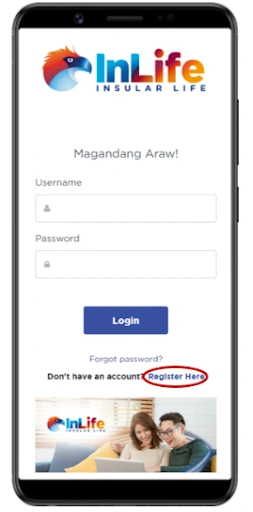

For first time policy holders, you may register via the app by clicking the Register Here in the InLife App and proceed to follow the instructions.

After the registration you will need to verify your email and answer security questions.

Upon email address verification, elect own password or activate biometric log-in feature.

Password nomination is the last step for registration.

- Review your InLife policy details, benefits and retrieve your most recent policy information.

- Monitor VUL funds. Know how much funds you have anytime, anywhere with real-time updates.

- Connect with InLife via e-mail, phone or Financial Advisor and even schedule a visit to InLife branches.

- Discover InLife's online platforms as the app provides quick links to other InLife sites such as InLife Health Care, InLife Solutions, and Sheroes websites.