Systematic Global Sustainable Income Fund

A first of its kind in the country, this fund provides regular income payouts through an Environment, Social, and Governance (ESG) focused investment portfolio. This fund is available in Philippine Peso and US Dollar.

Today, most stakeholders - from shareholders, to employees, customers, communities, and regulators - lean towards companies that advance ESG principles.

It is important to invest sustainably, positioning capital in a responsible and sustainable way, as it contributes to financial performance over the long term.

To provide customers' investments a head start in sustainable investing, InLife launches the Systematic Global Sustainable Income Fund (GSIF).

Why Should You Make GSIF Part Of Your Portfolio?

Sustainable Investing

GSIF uses ESG-related insights in identifying companies positioned to succeed in the long-term.

Attractive Income

GSIF can provide income payouts to build a more secure future for policyholders and their loved ones.

Systematic Approach

GSIF emphasizes data-driven insights, scientific testing, and disciplined portfolio construction techniques to seek its identified object.

What is GSIF's Asset Allocation?

GSIF is available through:

Earning your first million to achieve your life goals can be faster and easier.

Build your own personalized life insurance plan that keeps you on track to reach your financial destination.

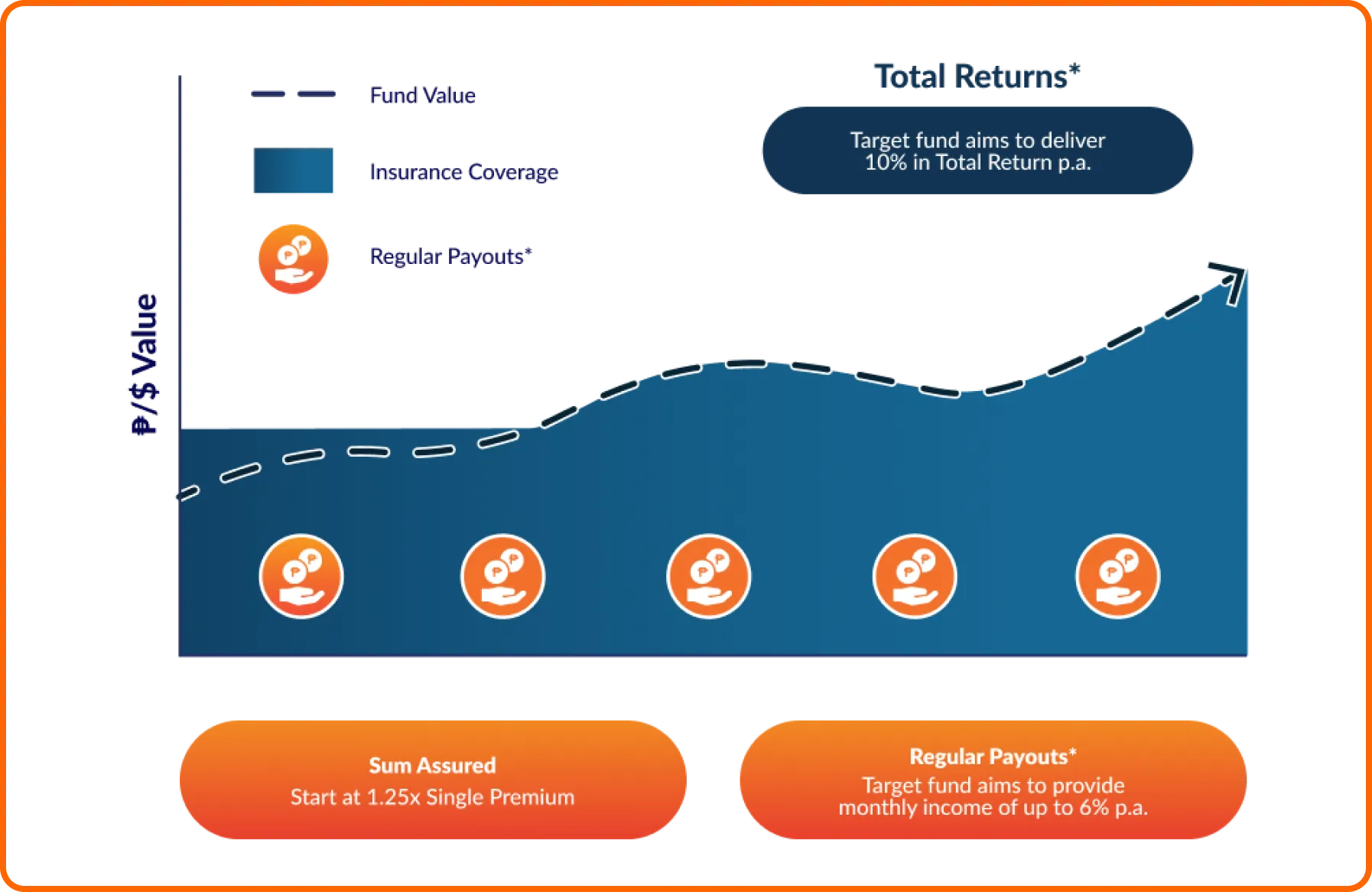

How does GSIF in Solid Fund Builder work?

Your insurance coverage is the sum assured or the fund value whichever is higher.

The winners of tomorrow are the champions of sustainability.

Avail of Systematic Global Sustainable income Fund today.

Talk to an InLife Financial Advisor

If you would like to speak with one of our financial advisors about the plan in greater detail, kindly fill out the information below.